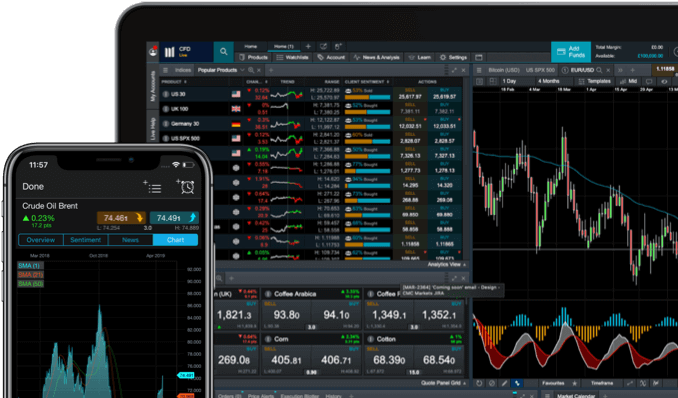

Cfd trading: Your Gateway to Forex Trading Success

Are you thinking about trading stock markets, although not certain how to start? Agreement for Variation (CFD) trading could just be the best selection for you. Cfd trading can be a highly flexible and well-liked way to business stocks, foreign currencies, indices, and commodities. On this page, we’ll provide a thorough manual on everything you should know about Cfd trading.

1. Exactly what are CFDs?

CFDs are contracts between traders and agents, which permit forex traders to predict regardless of whether the price tag on an actual advantage will climb or drop. CFDs make it possible for dealers to speculate on selling price motions with out owning the actual advantage. In addition, CFDs enable forex traders to trade on border, meaning they just need to placed down a fraction of the entire trade worth to start a position.

2. What are the benefits of Cfd trading?

One of the leading great things about cfd trading may be the versatility it includes. Dealers can industry a wide array of possessions, which includes stocks, indices, foreign currencies and merchandise. Furthermore, CFDs permit forex traders to profit from both increasing and slipping costs. Cfd trading also provides access to actual-time market details, minimizing the potential risk of details asymmetry.

3. What are the perils associated with Cfd trading?

Like all trading, Cfd trading requires hazards. The key danger linked to CFDs is that you may shed more money than you initially devoted. Traders must placed down a put in or border, and if the market movements against them, they could be expected to deposit more border to keep up their placement. In addition, investors could be strike rich in transaction costs, especially if they frequently close and open placements.

4. Just how do you decrease the potential risks of Cfd trading?

Firstly, it’s crucial that you recognize the very idea of leverage and the way it has an effect on your trading. Influence is really a resource that will amplify your potential revenue, but it can also improve your probable deficits. Additionally, make certain you will have a audio trading strategy and stay with it. Use quit deficits and get-earnings requests to shield your transactions from volatility. Last but not least, pick a reliable brokerage who delivers adverse stability protection, so that you can never lose more money than you settled.

5. How can you get going with Cfd trading?

To get started with Cfd trading, you will have to select a respected agent and open up a trading account. It’s important to do your research and select a broker who provides the possessions you wish to trade and contains a competitive fee framework. Once you’ve done this, you are able to fully familiarize yourself with the trading foundation, spot the first industry and begin improving your trading technique.

In a nutshell

To conclude, Cfd trading is really a adaptable and well-known approach to trade stock markets. Cfd trading provides an array of benefits, which includes accommodating trading options, true-time market data, and the cabability to cash in on both rising and falling prices. However, as with every trading activity, there are natural threats, and it’s important to actually recognize and manage these efficiently. By using the methods outlined in the following paragraphs, you can lessen your hazards and increase your chances of accomplishment in Cfd trading.